Have you ever looked at a sleek pair of kicks that cost more than a monthly rent and wondered if these could make money? Luxury sneakers have people’s attention as items to flaunt and as an investment opportunity. With limited runs and rare designs, some sneakers have been appreciated over time and have become an attractive alternative to traditional investments. Finding great sneaker shoes in Dubai might seem impossible when looking at high-end brands. But don’t worry; let’s explore how the world of streetwear is becoming intertwined with smart investments. Limited-edition collaborations and brand culture have turned sneakers into valuable assets. These sneakers could offer more than just style, making them a potential goldmine for savvy investors.

The rise of sneaker investing

The landscape of footwear has undergone a significant transformation. Initially, a niche interest rooted in sports and music subcultures, sneakers have transcended their functional origins to become a prominent asset class. The fervor surrounding limited releases generates considerable consumer activity, with resale platforms witnessing substantial financial exchanges. It is now not unusual for in-demand models to dramatically increase in value, and perception is turning from sneakers as a medium of styling to a potential place to invest — a transition from fashion statement to financial opportunity.

• The sneaker market has evolved from a subculture to a global phenomenon.

• Limited-edition releases now attract investor interest alongside enthusiasts.

• Resale values for specific sneakers can far exceed their original retail price.

• This appreciation has led to sneakers being viewed as alternative investments.

• The motivation for acquiring luxury sneakers now includes financial gain.

Factors driving sneaker investment value

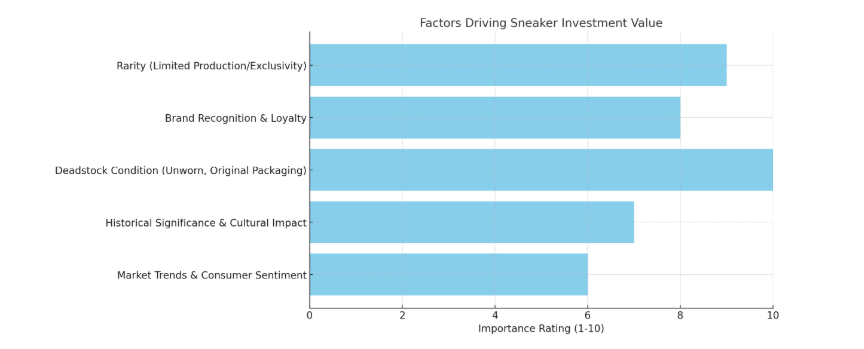

Here's a bar graph representing the factors driving sneaker investment value. Each factor is rated on a scale from 1 to 10 based on its importance:

• Rarity (limited production/exclusivity) has the highest impact on investment value, rated 9.

• Brand recognition & loyalty follow closely at 8, emphasizing how well-established brands influence demand.

• Deadstock condition (unworn, original packaging) is rated the highest at 10, underscoring the importance of pristine condition for valuable sneakers.

• Historical significance, cultural impact, market trends, and consumer sentiment are also essential but slightly lower in value at 7 and 6, respectively.

Identifying investment-worthy sneakers

Discerning which sneakers possess strong investment potential requires a keen eye and informed analysis, especially when choosing the best sneakers for your lifestyle. While no fool proof method exists, specific indicators can guide prospective investors. Limited-edition drops and collaborations with prominent figures in design or art are often precursors to future value. In addition, sneakers with a deep history and loyal customer base have long-lasting desirability. Thus, paying attention to reliable sneaker news outlets and market reports can be helpful.

• Monitor limited-edition releases and influential collaborations.

• Consider the historical significance and heritage of the sneaker model.

• Follow reputable sneaker news and market analysis platforms.

• Engage with experienced collectors in online communities and forums.

• Look for models with strong existing fanbases and cultural relevance.

Opportunities in sneaker investing

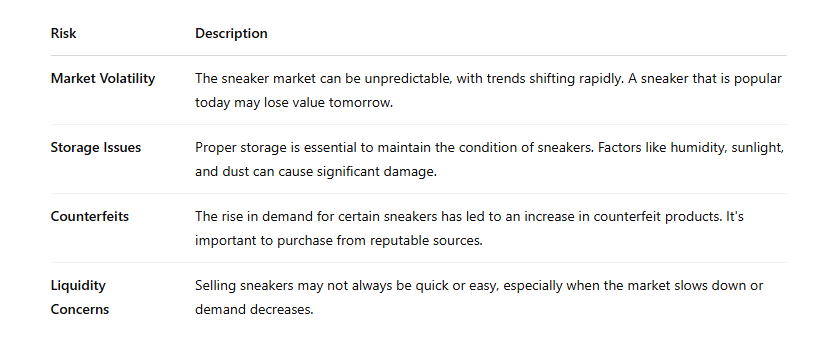

Like investing in stocks, sneaker investing has risks—the market can fluctuate, and trends can change in a snap. Of course, storage issues could damage the sneakers if they're not in the right environment. Due to high demand, there's a danger of counterfeiting, and there are questions about liquifying an asset if you want to, as it might not always be an easy or quick sale.

Storing and authenticating your sneaker investments

Preserving the state and authenticating collectible sneakers is integral to securing the investment value. Proper storage practices must be employed to avoid degradation. This means storing sneakers in a stable-temperature environment, not near direct light exposure. They can keep their structural integrity by using acid-free materials and shoe trees. Additionally, keeping the box increases their desirability and resell value. When making a transaction, it is highly responsible to ensure it is genuine.

• Store sneakers in cool, dry places away from sunlight.

• Use acid-free tissue paper and shoe trees to maintain shape.

• Keep sneakers in their original boxes for optimal preservation.

• Purchase from trusted retailers or platforms with authentication services.

• Consider third-party authentication for high-value transactions to avoid fakes.

The long-term outlook for luxury sneaker investments

Investing in luxury sneakers may very well be our best future investment— at least, that is what the data say. Surging global demand for rare and collectible footwear and the growing integration of streetwear into the mainstream fashion economy point to ongoing demand. However, a cautious strategy demands considerable research and a grasp of the risks embedded in the market. A diversification strategy with legendary iconic models and promising up-and-comers might help reduce volatility in this new asset class, offering benefits for UAE investors looking to capitalize on emerging trends in luxury goods.

• Global demand for rare and collectible sneakers is projected to grow.

• The increasing mainstream adoption of streetwear supports this trend.

• Thorough research and risk assessment remain crucial for investors.

• Diversifying investments across iconic and emerging models is advisable.

• Long-term value can be found in understanding market dynamics and cultural shifts.

Conclusion

Remember, these are only possible returns, but the world of luxury sneakers is a fascinating area where fashion meets potential investment. Charting a course in this evolving marketplace requires a potent mix of passion and practicality. Knowing the value drivers and risks involved and securing proper authentication and storage is critical for any still in the aspirational collector or investor stage. It's still a work in progress, as new trends and releases are changing the game. We invite you to share your experiences and insights in the comments section. If one is interested in keeping ahead in the world of valuable collectibles, seeking out some of the specialized resources that will give you pinpointed insights should be your next move.

Write a comment ...